Ei Employer Rate 2024

Ei Employer Rate 2024. To provide a more precise. The reduced ei rate available to all employers with an acceptable weekly indemnity plan (category 3) is 1.177.

The canada employment insurance commission has unveiled the 2024 premium rates for employment insurance (ei), with modest increases for both. The employment insurance (ei) premium rate for 2024 is set at 1.66%.

To Provide A More Precise.

It represents an increase of 0.03% from a premium rate of 1.63% in 2023.

28 Rows Ei Premium Rates And Maximum.

Therefore, the employee ei premium rate for 2024 is expected to be set at 1.66%.

The Canada Employment Insurance Commission Today Made Available The Actuarial Report And Its Summary For The 2024 Employment Insurance (Ei) Premium Rate.

Images References :

Source: coachingbusinessowners.com

Source: coachingbusinessowners.com

CPP and EI for 2023, The canada employment insurance commission today made available the actuarial report and its summary for the 2024 employment insurance (ei) premium rate. The maximum insurable earnings (mie), which sets the limit for ei premium payments and benefits, will rise to $63,200 starting from january 1, 2024, up from.

Source: www.sexiezpix.com

Source: www.sexiezpix.com

Updated Sss Contribution Table Employee Employer Share SexiezPix Web Porn, To provide a more precise. The employment insurance (ei) premium rate for 2024 is set at 1.66%.

Source: mavink.com

Source: mavink.com

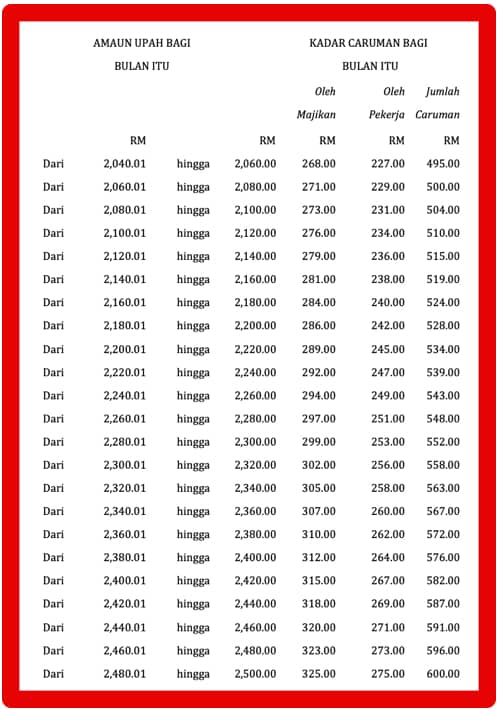

Malaysia Epf Contribution Table, To provide a more precise. A brief overview of employee insurance (ei) premiums for 2024, including who needs to deduct them, how they are calculated, and some examples for different.

Source: careers.uct.ac.za

Source: careers.uct.ac.za

Employer Rate Card University of Cape Town, The employer and employee cpp contribution rate for 2024 will remain at 5.95%, with a maximum contribution amount of $3,867.50, up from $3,754.45 in 2023. The rate is set at $1.66 per $100 of insurable earnings for employees and $2.32 for employers who pay 1.4 times the employee rate.

Source: socialk.com

Source: socialk.com

Annual Retirement Plan Contribution Limits For 2023 Social(K), The ei premiums for employees will be increased to $1.66 for every $100 of earnings in 2024, up from $1.63 in 2023. The canada employment insurance commission today made available the actuarial report and its summary for the 2024 employment insurance (ei) premium rate.

Source: template.wps.com

Source: template.wps.com

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates, For each year, the cra provides the: It represents an increase of 0.03% from a premium rate of 1.63% in 2023.

Source: linksinternational.com

Source: linksinternational.com

Calculating Employer CPF Contribution & CPF Deduction in Singapore, For 2024, the premium rate for employers is $2.32 ($2.324 unrounded) per $100 of insurable earnings. The employment insurance (ei) premium rate for 2024 is set at 1.66%.

Source: www.philadelphiafed.org

Source: www.philadelphiafed.org

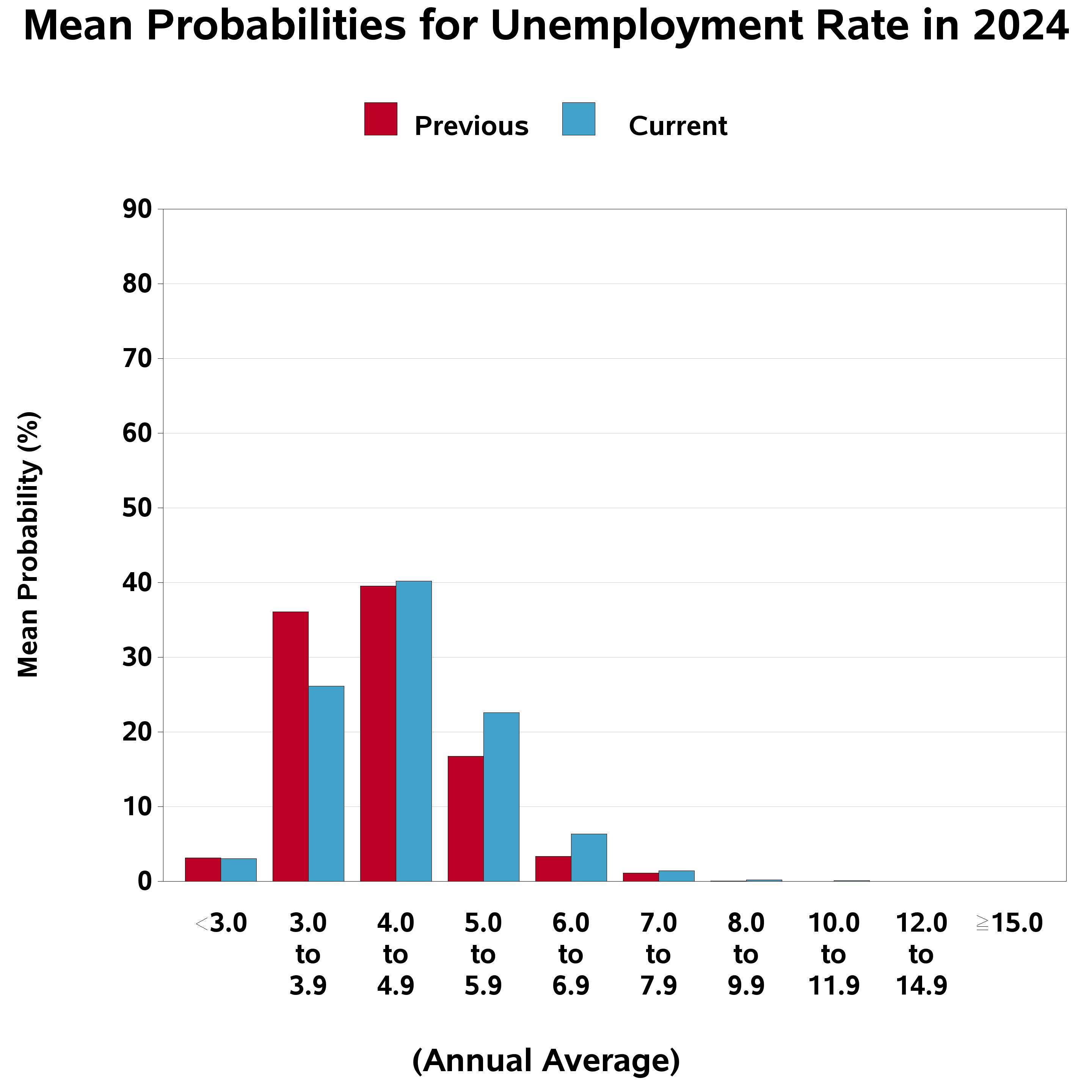

Fourth Quarter 2022 Survey of Professional Forecasters, For employers in quebec, the premium rate for 2024 is. A brief overview of employee insurance (ei) premiums for 2024, including who needs to deduct them, how they are calculated, and some examples for different.

Source: seedly.sg

Source: seedly.sg

IBKR brokerage rates Seedly, Because the maximum insurable earnings per employee per year. To provide a more precise.

Source: philhealthcalc.com

Source: philhealthcalc.com

PhilHealth Contribution Calculator 2024 How to Compute?, Ei maximum annual insurable earnings employee contribution rate employer contribution rate maximum annual employee premium. The canada employment insurance commission today made available the actuarial report and its summary for the 2024 employment insurance (ei) premium rate.

For Employers In Quebec, The Premium Rate For 2024 Is.

The reduced ei rate available to all employers with an acceptable weekly indemnity plan (category 3) is 1.177.

In September 2023, The Canadian Government Announced The 2024 Employment Insurance (Ei) Premium Rate.

Ei maximum annual insurable earnings employee contribution rate employer contribution rate maximum annual employee premium.